Rising Security Concerns Drive Global Demand for Physical Intrusion Detection Systems

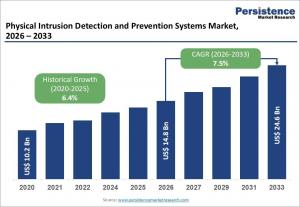

The physical intrusion detection and prevention systems market is set to grow from US$14.8 billion in 2026 to US$24.6 billion by 2033 at a 7.5% CAGR

BRENTFORD, ENGLAND, UNITED KINGDOM, January 29, 2026 /EINPresswire.com/ -- The Physical Intrusion Detection and Prevention Systems Market is gaining strong momentum as organizations worldwide prioritize physical security alongside digital safeguards. These systems are designed to detect unauthorized access, breaches, or suspicious activities across facilities, infrastructure, and assets, enabling real-time alerts and rapid response. Growing concerns around terrorism, theft, vandalism, and critical infrastructure protection are pushing enterprises and governments to invest heavily in advanced physical security solutions.

In 2026, the global physical intrusion detection and prevention systems market size is estimated at US$ 14.8 billion and is projected to reach US$ 24.6 billion by 2033, expanding at a CAGR of 7.5% during the forecast period. Key growth drivers include the rising deployment of AI-powered video surveillance, biometric access control systems, and perimeter intrusion detection technologies. Hardware currently leads the market due to widespread installation needs, while North America dominates regionally owing to high security spending, strict regulatory frameworks, and early adoption of smart security technologies.

𝐆𝐞𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/samples/21409

Key Highlights from the Report

The global physical intrusion detection and prevention systems market is projected to grow at a steady CAGR of 7.5% between 2026 and 2033.

Hardware components are expected to account for nearly 55% of total market share in 2026.

Video surveillance systems remain the leading system type due to their scalability and AI-driven analytics.

Government and public sector entities represent the largest end-user segment globally.

North America dominates the market, while Asia Pacific is the fastest-growing region.

Market Segmentation Analysis

The physical intrusion detection and prevention systems market is segmented by component, system type, and end-user industry, each contributing uniquely to overall growth. By component, the market is divided into hardware, software, and services. Hardware—including cameras, sensors, alarms, and access control devices—holds the largest share due to continuous demand for new installations and infrastructure upgrades. However, services such as system integration, maintenance, and managed security services are witnessing the fastest growth, driven by the complexity of modern security ecosystems.

Based on system type, the market includes video surveillance, access control systems, perimeter intrusion detection systems, and biometric systems. Video surveillance leads the segment, supported by advancements in AI-based facial recognition and behavioral analytics. Meanwhile, biometric systems are experiencing rapid adoption across high-security environments such as airports, government buildings, and financial institutions. By end-user, government, BFSI, industrial facilities, and commercial enterprises are the key contributors, with BFSI emerging as the fastest-growing segment due to rising regulatory compliance and fraud prevention needs.

Regional Insights and Market Trends

North America continues to lead the physical intrusion detection and prevention systems market, accounting for approximately 35% share in 2026. The region benefits from early technology adoption, strong homeland security initiatives, and increasing investments in critical infrastructure protection. The presence of major security technology providers and continuous innovation in AI-enabled surveillance further strengthens North America’s dominance.

Asia Pacific is projected to be the fastest-growing regional market, registering a CAGR of nearly 11% through 2033. Rapid urbanization, expanding smart city projects, and rising security concerns across India, China, and Southeast Asia are driving adoption. Governments in the region are increasingly investing in large-scale surveillance networks, biometric identification programs, and perimeter security systems to enhance public safety and infrastructure resilience.

𝐃𝐨 𝐘𝐨𝐮 𝐇𝐚𝐯𝐞 𝐀𝐧𝐲 𝐐𝐮𝐞𝐫𝐲 𝐎𝐫 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/request-customization/21409

Market Drivers

One of the primary drivers of the physical intrusion detection and prevention systems market is the growing threat landscape across public and private assets. Rising incidents of theft, terrorism, and unauthorized access have heightened the need for proactive security solutions. Organizations are moving away from reactive security measures toward intelligent systems that provide real-time threat detection and automated alerts.

Technological advancements are also fueling market growth. The integration of artificial intelligence, machine learning, and IoT enables smarter surveillance, predictive threat analysis, and reduced false alarms. These capabilities improve operational efficiency and make intrusion detection systems more reliable and cost-effective for large-scale deployment.

Market Restraints

Despite strong growth prospects, the market faces challenges related to high initial investment costs. Advanced intrusion detection systems require significant capital for hardware procurement, installation, and integration, which can be a barrier for small and medium-sized enterprises. Ongoing maintenance and system upgrades further add to the total cost of ownership.

Data privacy and regulatory concerns also pose restraints. The widespread use of video surveillance and biometric systems raises questions around data protection and misuse of personal information. Compliance with varying regional regulations can slow deployment and complicate cross-border implementation of physical security solutions.

Market Opportunities

The growing adoption of smart cities and intelligent infrastructure presents significant opportunities for the physical intrusion detection and prevention systems market. Governments worldwide are investing in integrated security platforms that combine surveillance, access control, and analytics to ensure urban safety and efficient monitoring of public spaces.

Emerging markets offer untapped potential due to increasing infrastructure development and rising awareness of physical security risks. Additionally, the shift toward cloud-based security management and managed services creates new revenue streams for solution providers, enabling scalable and flexible deployment models for diverse end-users.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/checkout/21409

Reasons to Buy the Report

✔ Gain in-depth insights into market size, growth trends, and future outlook through 2033.

✔ Understand key drivers, restraints, and opportunities shaping the physical security landscape.

✔ Identify leading segments and high-growth regions for strategic investment decisions.

✔ Analyze competitive dynamics and recent technological developments in the market.

✔ Support data-driven decision-making with reliable forecasts and industry insights.

Company Insights

Honeywell International Inc.

Bosch Building Technologies

Johnson Controls

Siemens AG

Axis Communications

Hikvision Digital Technology

Dahua Technology

Schneider Electric

Recent Developments:

In March 2025, Honeywell launched its 50 Series CCTV cameras, marking its first security products designed and manufactured in India under the “Design in India, Make in India” initiative. Additionally, several leading players are expanding AI-driven surveillance portfolios and forming strategic partnerships to enhance real-time threat detection and global market reach.

Related Reports:

Pooja Gawai

Persistence Market Research

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.